what is the property tax rate in dallas texas

Its easy to pay off your property taxes when you call Tax Ease. 15 and are due Jan.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Tax Liens by the Numbers.

. Dallas administrators reviewed Tuesday the citys 451 billion proposed budget for the 2023-24 fiscal year. The following table provides 2017 the most common total combined property tax rates for 93 Houston area cities and towns. Weve had reductions every year starting with 158000 in 2014 from 784k to 626k in2015 144000 from 770k back down to 626k and so on through 2019 when they reduced my.

Total school district rates average 3446 mills. The median property tax in Grayson County Texas is 1519 per year for a home worth the median value of 99600. Texass median income is 62353 per year so the median yearly property tax paid by Texas residents amounts to approximately of their yearly income.

The exact property tax levied depends on the county in Texas the property is located in. In total the highest millage rate in the county is in the City of Jonesboro in the Valley View School District. North Texas Property Management 3415 Custer Road Suite 122 Plano TX 75023.

While those high rates will certainly affect the budgets of retirees there are several helpful exemptions. Addison Dallas isd. Compare by city and county.

Do you know what Texas property tax exemptions are available to you. The median property tax in Austin County Texas is 1903 per year for a home worth the median value of 146500. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

Learn about six property tax exemptions in Texas with this helpful article from Tax Ease. Is your fee based on the total tax saving lower 100000 25 total tax rate save 250 or just the tax saving portion since the senior have school tax. DFW counties property tax rates.

North Texas Property Management is a full-service residential property management company serving clients in the North Dallas suburbs. Tax management for vacation rental property owners and managers. After a municipality issues a tax lien.

The decision whether to render depends upon the owners specific circumstances including record keeping the risks involved and corporate culture. Houston citiestowns property tax rates. The total property tax millage rate there is 425 mills.

View DFW Property Tax Rates. Failure to pay these taxes before Feb. The City of Dallas is.

The state sales tax rate in Texas is 625 and local rates can be as high as 2. For example the Plano Independent School District levies a 132 property tax rate and the Frisco Independent School District levies a 131 property tax rate. Are over 65 should we still file the protest.

Average Effective Property Tax Rate Median Home Value Average Yearly Property Tax Bill. Austin County collects on average 13 of a propertys assessed fair market value as property tax. The law clearly requires an income property owner to render.

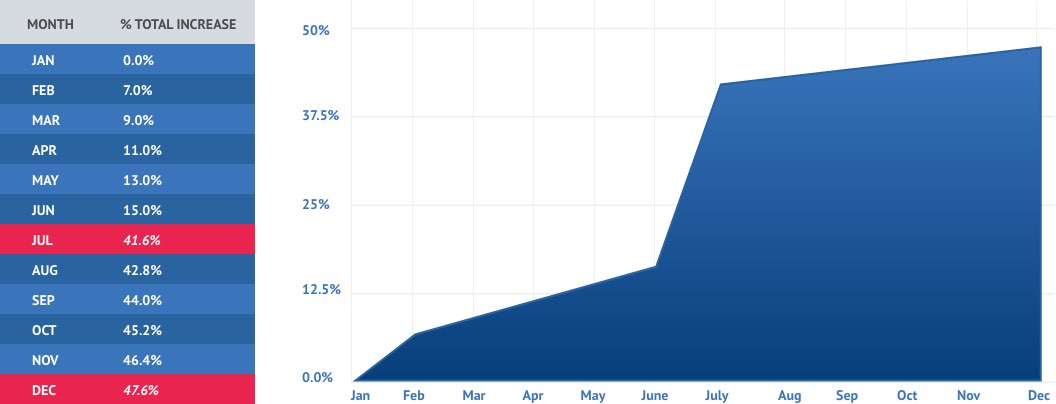

The figure is based on a property tax rate of 7458 cents per 100 assessed valuation a reduction of about 275 cents from last years rate. Most Texas seniors qualify from homestead property value exemptions of 35000 to 40000 depending on their individual taxing districts which leads to a significantly lower property tax bill. D-2 Notwithstanding Subsections d and d-1 of this section the legislature by general law may provide for the reduction of the amount of a limitation provided by Subsection d of this section and applicable to a residence homestead for a tax year to reflect any statutory reduction from the preceding tax year in the maximum compressed rate as defined by general.

Dallas property tax rate is higher than many major Texas cities and under pressure from taxpayers the City Council had approved six consecutive property tax rate decreases totaling 237 cents. Property tax tates for all 1018 Texas independent school districts are available by clicking on this Texas school districts property tax rates link. The minimum combined 2022 sales tax rate for Dallas Texas is.

Dallas County collects on average 218 of a propertys assessed fair market value as property tax. The State of Texas offers special protections for the property owners in Texas and one such protection is the over 65 exemption. With three base locations in Dallas Houston and McAllen TX we provide hassle-free Texas property tax loans for residential or commercial property owners.

Whats My Home Worth. 1 results in a penalty of 6 percent plus 1 percent per month until July 1 when the penalty becomes 12 percent. Obtain an MLS COMP Report in Seconds.

The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes. This is the total of state county and city sales tax rates. The penalty is 10 of the tax bill which is the tax rate multiplied by the market value of the personal property.

Grayson County has one of the highest median property taxes in the United States and is ranked 758th of the 3143 counties in order of median property taxes. Southside Place which has a combined total rate of 194 percent has the lowest property tax rate in the Houston area and Galena Park with a combined total rate of 302 percent has. This is driven largely by the high rates used to fund local school districts.

School District Property Tax Freeze. Weve helped thousands of Texans save time and money with Texas property tax loans. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes.

Grayson County collects on average 153 of a propertys assessed fair market value as property tax. Addison Carrollton-Farmers Branch isd 252. The average rate Texans can expect to face is about 82.

Find Property Tax Rates for Dallas Forth Worth. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. LLC Dallas 14800 Landmark Blvd.

First lets address growing property tax values. Bills are mailed about Oct. Look up 2022 sales tax rates for Dallas Texas and surrounding areas.

Tax rates are provided by Avalara and updated monthly. The typical homeowner in Craighead County pays 794 annually in property taxes. The Dallas budget proposes lowering its property tax rate by 275 cents from 7733 to 7458 cents per 100 valuation.

The countywide property tax rate averages 057. Property Tax Protest has saved me tax money for the past six years. The following table provides 2017 the property tax rates for 13 Dallas Fort Worth area counties that are included in the Dallas-Fort Worth-Arlington metropolitan area.

Broadnax said the proposed tax rate reduction represents the largest decrease. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. Weve helped thousands of Texans.

Additionally individual taxing districts can offer exemptions starting at 3000. In King County Washington property values increased 9 from 2021 to 2022. Austin County has one of the highest median property taxes in the United States and is ranked 504th of the 3143 counties in order of median property taxes.

Contact ARG Realty LLC. Property taxes are collected by the Dallas County Tax Office in one installment. The firm currently manages over 50 million dollars worth of residential real estate and leases well over 100 properties a year.

What Is The Property Tax Rate In Plano Texas Real Estate Luxury Real Estate Agent Real Estate Agent

Property Tax Comparison By State For Cross State Businesses

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Who Doesn T Want To Pay Less In Property Taxes Property Tax Tax Reduction Tax

Dallas Property Tax Property Tax Tax Consulting Tax

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Why Are Texas Property Taxes So High Home Tax Solutions

Property Taxes By State Embrace Higher Property Taxes

Are You Overpaying On Your Property Taxes

Abbott Backs Eliminating Largest Component Of Property Tax Bills In Texas The Texan

Property Tax How To Calculate Local Considerations

Tarrant County Tx Property Tax Calculator Smartasset

Looking For Dollar Saving Ideas In Rental Investment In 2022 Property Tax Investing Tax Reduction

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Buying Or Selling Celina Tx Real Estate The Timing Couldn T Be Bette Property Tax Real Estate Dallas Real Estate

Dallas Market Report Collin County Real Estate Market May 2022

Property Taxes How Much Are They In Different States Across The Us